When I talk to founders about funding their startups, their choice is usually binary: bootstrap and grow slowly, or raise VC, give up control and (try to) grow very fast.

But there’s a growing movement of founders (and investors) proving there’s a smarter middle path - raise a small, intentional round once, then grow to profitability instead of raising again - a model whose name is quickly gaining popularity: seedstrapping.

That’s why I’m excited about today’s guest: Zdenko Zvada.

Zdenko is a founder turned investor backing bootstrapped and “seedstrapped” SaaS businesses that focus on profitable growth instead of chasing unicorn exits.

He also writes Seedstrapped, a newsletter about alternative funding models and go-to-market strategies for SaaS founders. Most recently, he acquired No Code Founders from me - and now we run it together.

In this week’s edition, Zdenko breaks down why seedstrapping is becoming a meaningful alternative to traditional bootstrapping, and how no-code founders are perfectly positioned to make it work.

Sponsored by

Most prototypes take weeks to build. Figma Make does it in minutes.

Tell it what you want in plain English: "Make this a signup flow" or "Add a loading animation."

30 seconds later, you've got a working prototype.

You can connect real data from your APIs, test on any device, and tell buttons what to do without writing code.

This isn't just static screens - you're actually clicking through and using your product before you build it. If you're tired of waiting weeks to test an idea, check out Figma Make.

Bootstrapping has been the default option for most no-code founders that I’ve met over the past 2 years. Stay lean. Fund your product with customer revenue. Keep control.

And for good reason, bootstrapping teaches focus and discipline like nothing else. But it’s also slow, risky and in the early days, often lonely.

Meanwhile, venture capital pushes founders to move fast, hire early, and chase valuations that rarely reflect the reality of their businesses.

Seedstrapping lies somewhere between those two worlds.

What Seedstrapping Actually Means

Seedstrapping is a funding model for founders who want to stay independent but don’t want to bootstrap forever.

You raise a small, intentional round once, enough to reach product-market fit and become profitable within 12-18 months, then stop raising and grow through revenue.

The goal isn’t to stretch the runway for the next round.

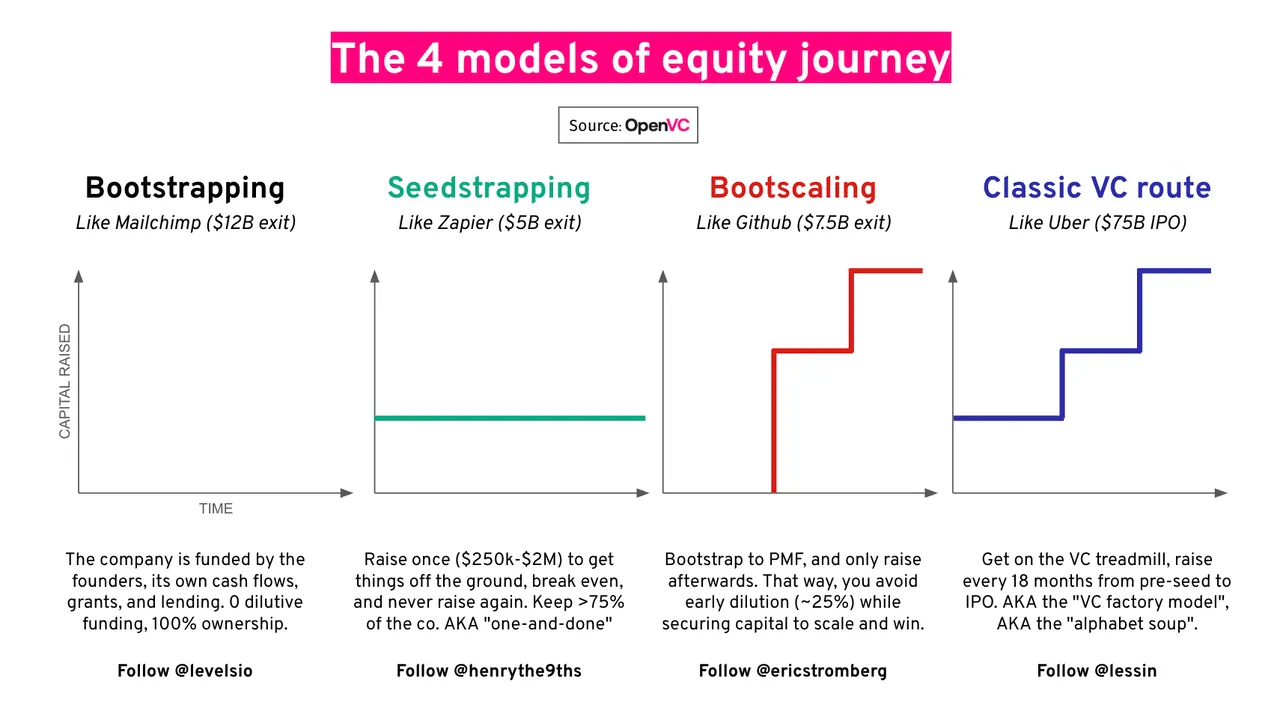

How It’s Different from Bootstrapping and VC

Here’s one of the best summaries of the 3 models I’ve seen out there:

Source: OpenVC

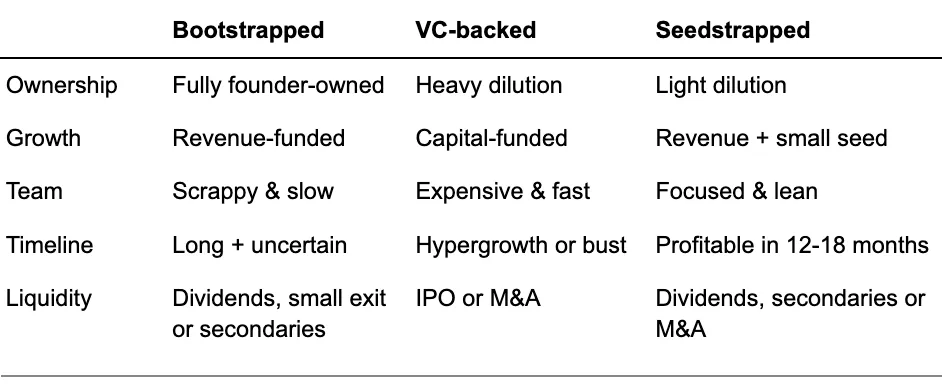

Most comparisons frame bootstrapping, VC and seedstrapping as funding options.

In my view, they’re much more than that. They shape how you build your company, how you make decisions and what kind of business you end up running.

Having bootstrapped my first company (and shut it down after one year), co-founded two VC-backed SaaS businesses, and now invested in two startups that build with the seedstrapping mentality - I’ve seen firsthand how different the mindset, incentives and trajectory can be for each one.

Source: Seedstrapped

Why now?

Seedstrapping is more relevant than ever in 2025:

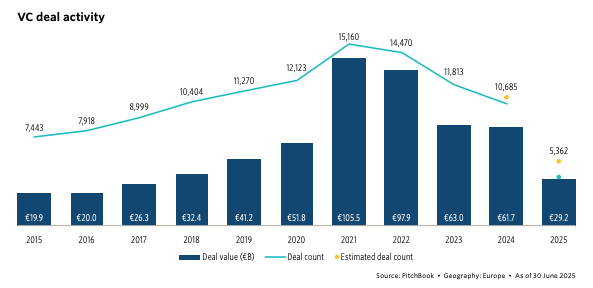

The VC boom is over - In Europe, deal value has fallen from €105B in 2021 to just €29B in 2025. Capital is still available, but it now comes with far higher expectations.

Source: Pitchbook

Profitability matters again - capital efficiency is no longer optional

Tools are cheaper, GTM faster - with no-code and AI real traction is within reach earlier

Founders are getting smarter - and know that raising doesn’t equal winning

Who It’s For and Why No-Code Founders Fit Naturally

Seedstrapping isn’t a universal playbook. It tends to fit founders who already have some traction and a clear sense of who they’re building for.

Usually that means:

SaaS or no-code businesses with early revenue (€10k-€100k ARR)

Products with high margins and low capital requirements

Founders who value control and long-term ownership

Small teams that can reach profitability on €200k–€1M of funding

It’s less suitable for deep-tech, hardware or network-effect markets where scale requires significant upfront investment.

No-code founders, however, are in a unique position to make it work. You can prototype in days, validate demand early, and automate much of what used to require a team. Customer revenue arrives sooner, and with lower burn you can reach breakeven earlier.

In that sense, no-code isn’t just a set of tools - it’s an enabler for the seedstrapped mindset. It gives founders the leverage that once demanded capital, and the freedom to grow at their own pace.

How Much Should You Raise and How Much Equity Should You Expect to Sell?

Most seedstrapped rounds fall between €200k and €1M, with 10–25% equity sold.

Valuations may be lower than VC equivalents, we typically look at €1M-€2.5M post-money range at Flying Founders, but the real trade-off is control.

You raise less money at a lower valuation, but you also:

keep far more ownership long-term,

avoid board or follow-on pressure, and

build optionality for dividends or future secondaries.

The goal here isn’t to finance growth at all costs - it’s to finance the path to self-sufficiency.

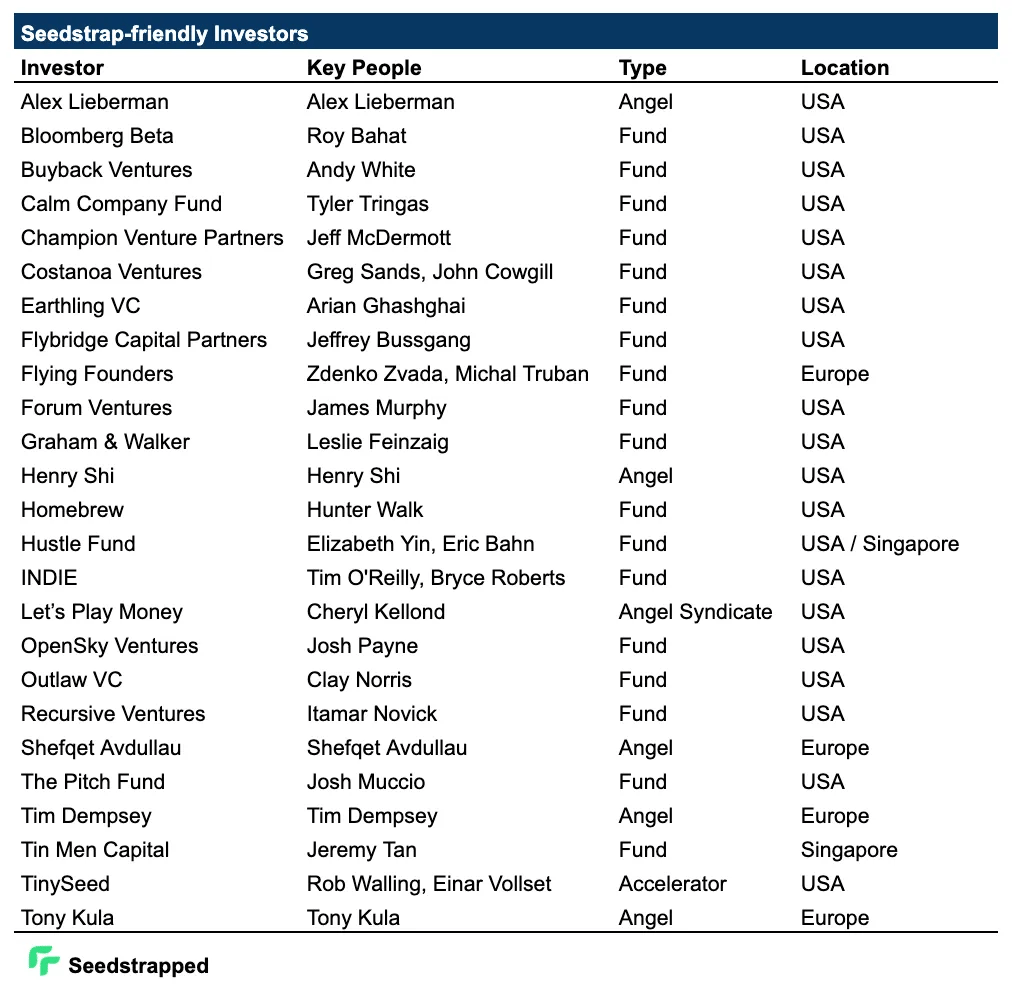

Who’s Investing in Seedstrapped Businesses?

The people funding seedstrapped businesses most often fall into 3 groups:

Angels & operators (often ex-founders) - individuals who’ve built and/or exited companies themselves and now back others taking a similar path.

Micro / alternative funds - smaller, nimble funds (often <$50m) that tend to write early checks, move fast and stay hands-on.

Family offices - patient capital with more flexibility than institutional VC. Many family offices now actively invest in early-stage companies, preferring sustainable growth and dividends over forced exits.

These investors care less about 100x outcomes and more about steady, compounding returns. They often provide capital plus hands-on support in GTM, ops, and finance - without the “grow or die” pressure of VC.

Here's my first stab at seedstrap-friendly investors directory, which will hopefully be growing over time:

Source: Seedstrapped

Biggest Success Stories

Some of the best examples come from SaaS founders who’ve taken this path:

Zapier (US) - raised $1.2M in 2012, profitable within 3 years, now valued around $5B.

StackCommerce (US) - raised ~$750K, reached ~$80M GMV, sold to TPG’s IMC in a high 8-figure exit.

Billdu (Slovakia) - raised ~€300K, scaled to 200k+ users, acquired by team.blue for an 8-figure sum.

Uplisting (UK/Ireland) - raised ~$300K, grew to €2–3M ARR, sold to AirDNA on founder-friendly terms.

UltimateSuite (Czechia) - raised ~$800K, acquired by ServiceNow in a mid 8-figure deal.

Usersnap (Austria) - raised ~$500K, hit $2.2M ARR, sold to saas.group.

Modern no-code founders like Marc Lou, John Rush quietly building €10k–€100k MRR businesses with no or minimal funding.

This is the early wave of founders building durable companies outside the venture treadmill.

The next global success stories won’t come from big funding rounds, they’ll come from small, determined teams (seedstrapped or bootstrapped) using AI to punch far above their weight.

Final Thoughts

How you fund your company shapes how you build it:

Bootstrapping gives you freedom but limits your pace

VC gives you speed but costs you control

Seedstrapping sits in between

For no-code founders, it’s feels like a natural fit. You can build fast, test early and reach revenue long before you need another round.

It’s not about how much you raise. It’s about raising for the right reason - to reach profitability and stay in control.

Good luck!

Zdenko

PS: We’re looking to invest $100k-$500k in 1-2 companies this Q4 at Flying Founders. If you’re building with the seedstrapping mindset and think that we can be the right fit - let’s connect!